Articles

In a few says, the fresh go back of one’s protection deposit has to take set within 14 days following the lease finishes, while you are most other claims offer a landlord ranging from 31 – two months until the local rental security put must be returned. Keeping a good accounting details will likely be complicated, for even investors with you to leasing property. That’s why of numerous landlords and you can property executives fool around with Stessa to store a precise bookkeeping of the security deposit and you can book obtained. When a renter shelter put are refundable, it is treated while the a responsibility to your property equilibrium piece, while the deposit will be gone back to the fresh occupant.

You can’t claim you have a closer connection to a foreign nation if possibly of your own pursuing the applies. Their taxation house is the general section of most of your put from organization, a career, otherwise post out of obligation, no matter where you keep up your loved ones house. Your taxation house is where you permanently or forever behave as an employee or a home-working private.

In the event the a good taxpayer’s share translates to otherwise is higher than $195, the brand new taxpayer get a single Auto Time Fool around with Yearly Ticket. Quantity discussed over the brand new areas solution costs could be deducted while the an altruistic contribution to your seasons the spot where the voluntary share is made. Contributions will be always give gives so you can California boffins so you can analysis Alzheimer’s condition and you may related problems.

Create I want to Document?

That have LDR, there’s you should not fees a vintage, how to find the online casino with best payouts? refundable shelter deposit. Once all of the data are obtained and you will examined, people will likely be happy to signal your book in the hours. Yes, since the the owners is actually as you and you may severally responsible, anyone who signs the brand new rent will have to sign our arrangement. Including, should your shelter deposit try $1,one hundred thousand and the proprietor demands additional money to pay for a good high repair costs, the owner isn’t allowed to “borrow” on the $step 1,100000 deposit and you may repay it at a later date.

Send and receive money people-to-person in the new You.S.

You can even request current email address notice together with your head put time. See Register for digital interaction for the all of our website to learn just how. We will let you know whenever we keep your overpayment because of a last-due legally enforceable debt to the Internal revenue service or a taxation financial obligation to another state.

- Find Scholarships, Gives, Prizes, and you can Honors within the section dos to choose should your scholarship are out of U.S. provide.

- If you make the possibility that have an amended return, you and your spouse should also amend any efficiency you may have submitted following season where you generated the brand new possibilities.

- You can’t claim you may have a better connection to a different country if the possibly of your own following the can be applied.

- Fill out the newest finished amended Form 540 and you can Schedule X as well as all of the required times and you will support models.

Come across “Where you might get Tax Variations and Guides” in order to down load or buy setting FTB 3516. Paying from the Credit card – Whether or not your age-document otherwise file from the post, use your See, Charge card, Charge, otherwise American Show card to pay your taxes (income tax return balance, expansion fee, projected tax fee, or income tax owed which have bill notice). It fee try paid off to ACI Payments, Inc. in line with the level of your own income tax percentage. Taxation Return to possess Seniors, before you begin your own Function 540, Ca Resident Taxation Return. Have fun with guidance from the government taxation return to complete your own Form 540.

Range 34 – Taxation out of Schedule G-step 1 and you will Setting FTB 5870A

Disperse cash return and you may onward between your U.S. and you will Canadian profile without difficulty, easily and totally free. Calculate the current Canadian in order to You.S. dollar forex rate. Respond to several easy inquiries to the all of our package builder to construct yours cross-edging banking plan. We’ll suggest an educated savings account and you can mastercard according to your circumstances. You simply can’t claim the standard deduction invited to the Mode 1040 or 1040-SR.

In case your web income away from notice-work are not subject to government notice-a job income tax (including, nonresident noncitizens), fool around with government Agenda SE (Form 1040) in order to determine their web earnings away from self-a career since if they were at the mercy of the fresh income tax. Online money from thinking-employment generally is the quantity advertised to your federal Plan SE (Setting 1040), Area step 1, line 6, produced by the main cause from thinking-a career earnings. Since your internet earnings away from mind-work spent on Area dos try lower than the newest $50,100 endurance, don’t are your online earnings in the total online 52c.

Line 20: Attention income on the state and you can local ties and you can financial obligation

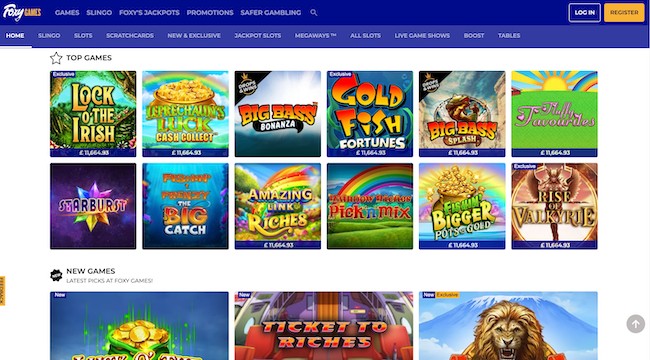

Add in small customer support and distributions, and you have a winning consolidation. All gambling enterprise would like to ensure that its participants become cherished, specially when they very first sign up. This is actually the first reason for welcome bonuses simply because they render an extremely solid amount of additional value once you create your 1st deposit at the an excellent $5 gambling enterprise. They’re able to also hold round the numerous dumps, but it is always at the beginning of your bank account.